So this is currently something that is impacting us. Daughter No 2 went traveling 18 months ago after being delayed 2 years due to the pandemic. Whilst biding her time she was working, did really well and breached the threshold of starting to pay her student loan off.

She is now in Australia, has been there a year, loved every minute and has another visa to stay even longer.

When she left the UK obviously her automatic payments stopped out of her wage and this eventually triggers something at The Student Loan Company (SLC). Then the letters started arriving (which were ignored) then the threat of bailiffs letters started arriving (which resulted in Mrs K sparking into action, as you can imagine!). So daughter No 2 was tasked with “sorting it out and sorting it out fast”

I started looking into this and was amazed how much disinformation there is about whether you should pay your loan whilst living abroad. The government (.gov website) are pretty clear you do, whereas ex-students living abroad generally seem to think you don’t. As always the truth and reality is somewhere in-between!

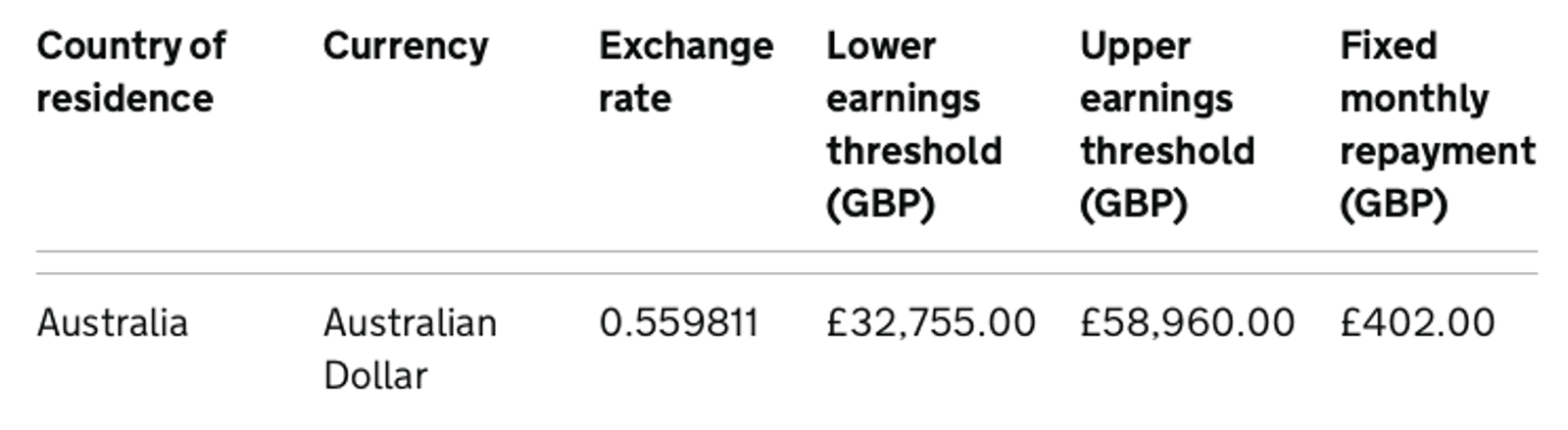

Wherever you are living in the world the amount you need to earn before starting to pay back your student loan is different and is probably set in relation to the cost of living in that country. As you can see from the extract below if you are living and working in Australia if you earn below the lower threshold (£32,755) you won’t need to pay anything back. Interesting this lower threshold is much higher than it is in the UK, which is £27,295. Conversely in you are in Vietnam payments start being due if you earn over £10,920. Click on the link below to see the full list

Student Loan International Thresholds

What Happens If You Don’t Pay Your Student Loan If You Move Abroad?

This is where there is most conjecture and for me disinformation which could prove extremely expensive.

There seems to be a consensus that you should not worry about it, ignore all the letters, the SLC have never taken anyone to court in a foreign country and in any case the loan gets written off after 30 years.

I am afraid this is only partly true. It’s true that the SLC has never instigated a foreign court case against a non-payer to date. Whilst that doesn’t mean they won’t in the future to my mind it would seem highly unlikely they would do so in the future.

“So it’s correct then there is nothing to worry about and the loan will get written off in 30 years”

Sort of but this is where the “buts” start. This is only the case if you are totally sure that you will never move back to the UK and that means never full time back to the UK, you’re still fine to visit on holiday but not to move back.

If you break off comms with the SLC they will put your account into default and you will have a monthly default charge added to your balance. If you were wondering what the “Fixed Monthly Repayment” amount was in the chart above, it’s the monthly default charge. So for every month you are in default £402 is added to your outstanding balance.

“So What, The Loan Is Still Written Off After 30 Years”

This is the kicker. Loan Accounts in default do not get written off, so if you come back you will need to continue paying your loan way after the 30 years cut off period. The example I gave to Daughter No 2 was if you came back after 10 years as well as your original loan (lets take an average of £50k) you will add on another 10 years worth of default payments (£50k) plus interest on top. You will be probably be looking at a loan balance of somewhere in the region of £150,000. That’s not quite the welcome home present you were expecting!

What Should You Do About Your Student Loan Before Moving Abroad?

Probably before moving abroad the last thing on your mind is contacting the SLC, you will have neither the time nor the inclination. Please do, it will save a mountain of time in the future especially when you might be on the other side of the world and contacting them is going to be much more difficult.

Daughter No 2 says they have been lovely with her and have got rid of the bailiffs and the default charges from her account, after she showed evidence that she hadn’t earned above the minimum threshold during the previous year.

They will almost certainly contact you every year to ask you to continue to show proof of earnings and until you breach the minimum threshold you will not have to pay anything and no penalty charge will be added to your balance.

So what should you do if you get a job that is above the minimum threshold? I’m afraid I can’t help with that one, you will have to make that decision yourself. I know what I would do and at least you know what will happen if you don’t pay it!

ps you probably thought that it was a strange image to use for this article of beach huts and not something like the Sydney Harbour Bridge or a kangaroo which is more typically Australian. Daughter 2 sent us that picture this morning, she has gone to the beach near Melbourne (where she is currently staying) the beach hut with the birds on has just been sold for £200,000. Australia is very expensive!